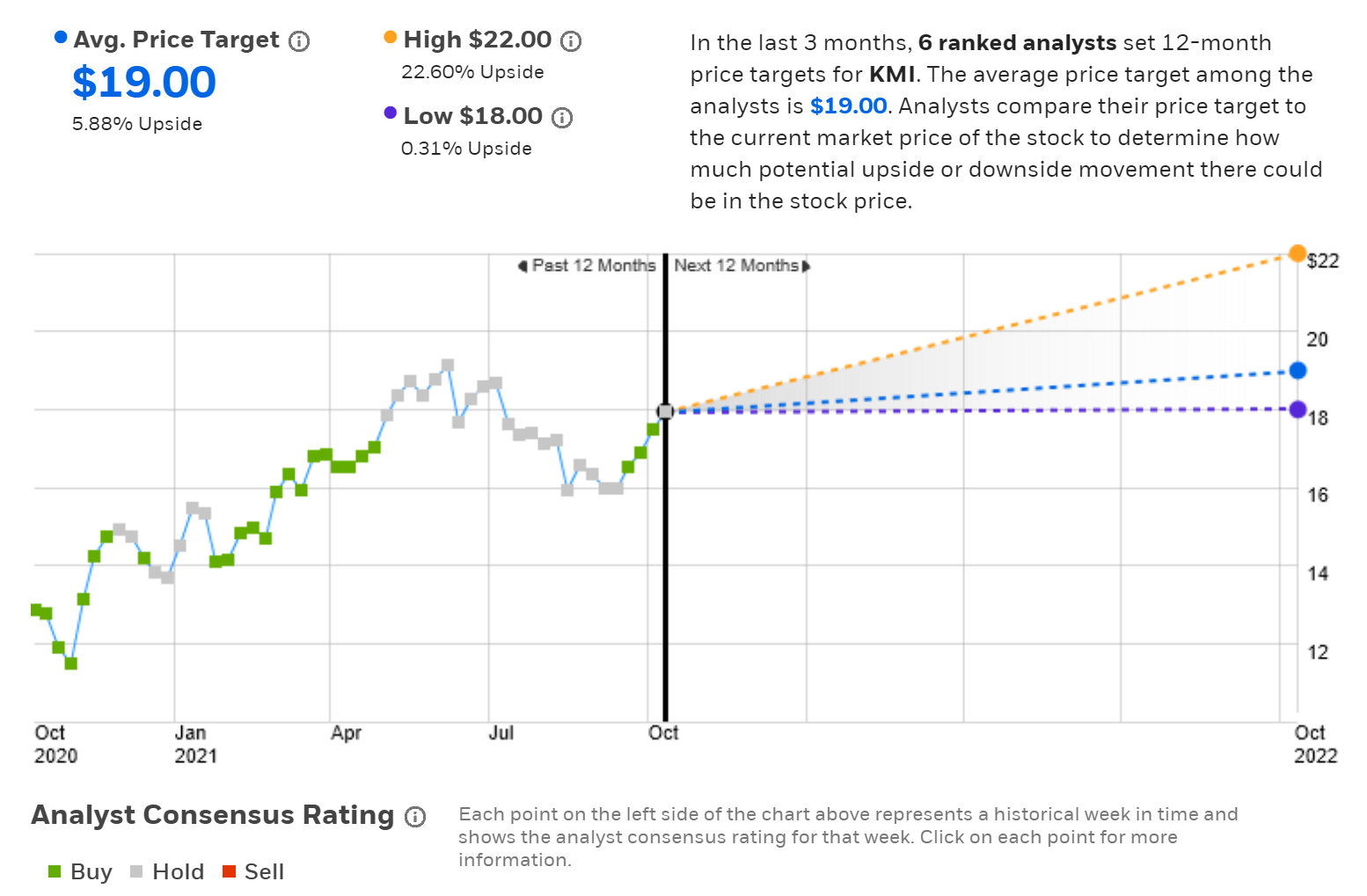

On average, they anticipate kinder morgan's share price to reach $17.82 in the next year. Stock forecast as of 2021 november 04, thursday current price of kmi stock is 16.960$ and our data indicates that the asset price has been in an uptrend for.

The average pg&e stock forecast 2026 represents a 335.82% increase from the last price of $12.2399997711182.

Kmi stock 5 year forecast. (kmi) registered a 0.52% upside in the last session and has traded in the green over the past 5 sessions. Is $15.05 , for 2026 nov. Based on these gigs, the overall price performance for the.

Their forecasts range from $15.00 to $22.00. A share price of $22 and an annual dividend of $1.25 would give kinder morgan a 5.6% annual dividend yield. Pair that with the company's strong balance sheet, and there's a serious case for kinder.

Earnings growth (this year) +85.42%: Where will enbridge be in 5 years? Stock outperforms market despite losses on the day nov.

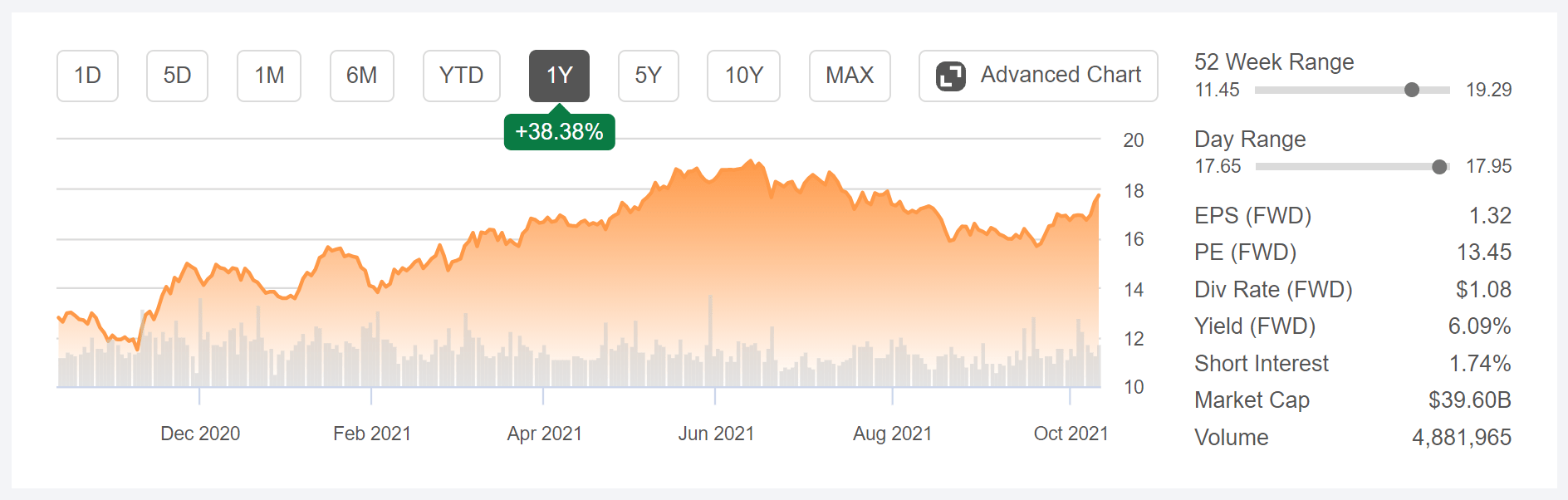

Earnings growth (next 5 years) +7.00%: Stock advisor list price is $199 per year. The stock spiked 0.52% in intraday trading to $18.48 this thursday, 10/14/21, hitting a weekly high.

For pg&e stock forecast 2026 (5 year), 12 predictions are offered for each month of 2026 with average pg&e stock forecast of $53.34, a high forecast of $53.9, and a low forecast of $52.99. Get our premium forecast now, from only $8.49! According to the data, the short interest in kinder morgan inc.

The stock has risen by 20.63% since the beginning of the year, thereby showing the potential of a further growth. Find the latest kinder morgan, inc. 66.485 * about the kinder morgan, inc.

Et by marketwatch automation kinder morgan inc. (kmi) stock quote, history, news and other vital information to help you with your stock trading and investing. This kmi chart of five year dividend yield, is inferred based upon our dividend and price history data which may not be complete or accurate.

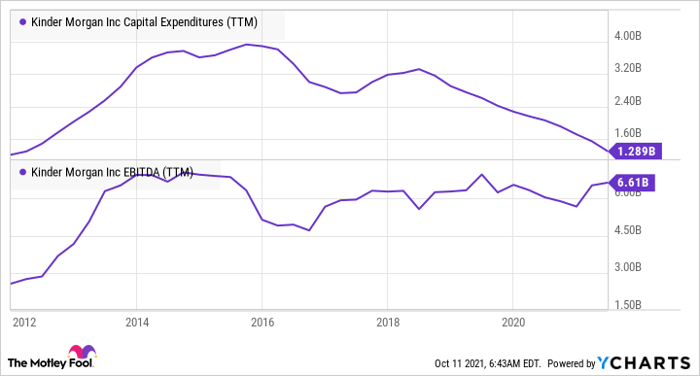

Is $15.15 , for 2025 nov. We would also point out that the forecast 0.6% annualised revenue decline to the end of 2021 is better than the historical trend, which saw revenues shrink 1.5% annually over the past five years. Kmi boasts an average earnings surprise of 46.5%.

Stock advisor launched in february of 2002. Trend analysis and forecast : Your current $100 investment may be up to $179.6 in 2026.

With its forward dividend at 1.08 and a yield of 6.36%, the company’s investors could be anxious for the kmi stock to gain ahead of the earnings release. Average daily price swing $0 (2.87% one month average) average daily percentage swing This suggests a possible upside of 9.6% from the stock's current price.

In that report, analysts expect kmi to post earnings of $0.23 per share. Is $15.88 , for 2022 nov. The zacks consensus estimate has increased $0.02 to $1.34 per share.

Is $16.44 , for 2030 nov. (kmi) stood at 1.26% of shares outstanding as of may 27, 2021; On average, 6 wall street analysts forecast kmi's earnings for 2022 to be $2,176,728,487, with the lowest kmi earnings forecast at $1,949,985,936, and the.

With an annual yield of 6.47%, the share has a forward dividend of 1.08 which implies that company’s dividend yield remained growing in trailing twelve months while having a 5 year average dividend yield of 4.49%. 10, 2021 at 5:03 p.m. The number of short shares registered in apr 29, 2021 reached 27.75 million.

In a normal year, without winter storm uri.

0 komentar:

Posting Komentar