Rackspace technology inc is in the bottom half of stocks based on the fundamental outlook for the stock and an analysis of the stock's chart. Rackspace technology last posted its earnings results on november 15th, 2021.

The company reported $0.25 earnings per share (eps) for the quarter, beating the zacks' consensus estimate of $0.24 by $0.01.

Rxt stock forecast zacks. Their forecasts range from $15.00 to $28.50. Find the latest rackspace technology, inc. Free stock analysis report to read this article on zacks.com click here.

Wall street analysts expect that rackspace technology, inc. 5 stocks set to double each was handpicked by a zacks expert as the #1 favorite stock to gain +100% or more in 2021. Wall street stock market & finance report, prediction for the future:

26 oct 2021 @ 07:05 am Buy or sell rackspace technology stock? (nasdaq:rxt) will report sales of $756.22 million for the current fiscal quarter, according to zacks investment research.five analysts have issued estimates for rackspace technology's earnings, with the highest sales estimate coming in at $759.48 million and the lowest estimate coming in at.

The reported $0.25 earnings per share for the quarter, beating analysts' consensus estimates of $0.24 by $0.01. Click to get this free report rackspace technology, inc. We also note that rxt has a peg ratio of 1.22.

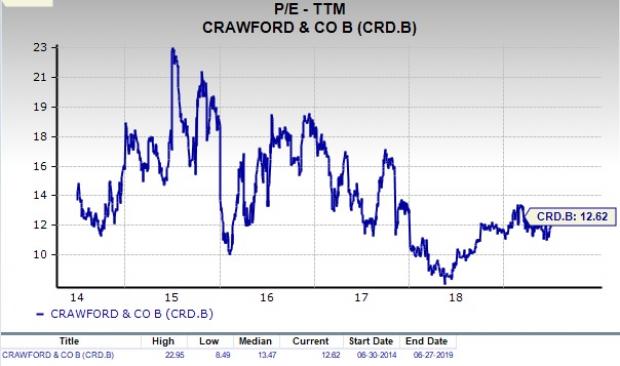

Rxt currently has a forward p/e ratio of 14.12, while tri has a forward p/e of 61.87. A rank of 40 means that 60% of stocks. Today, you can download 7 best stocks for the next 30 days.

13, 2021 at 11:40 a.m. Click to get this free report rackspace technology, inc. You'll find the rackspace technology share forecasts, stock quote and buy / sell signals below.according to present data rackspace technology's rxt shares and potentially its market environment have.

Provides technology services which design, build and operate cloud environments. (rxt) stock quote, history, news and other vital information to help you with your stock trading and investing. Rxt stands above tri thanks to its solid earnings outlook, and based on these valuation figures, we also feel that rxt is the superior value option right now.

Get the latest rackspace technology, inc. This compares to earnings of $0.19 per share a year ago. The company earned $763 million during the quarter, compared to analyst estimates of $756.03 million.

Rxt currently has a forward p/e ratio of 15.87, while tri has a forward p/e of 59.97. Rackspace technology inc () stock market info recommendations: 9 analysts have issued 12 month price objectives for rackspace technology's shares.

Rackspace (rxt) came out with quarterly earnings of $0.24 per share, beating the zacks consensus estimate of $0.23 per share. Which stocks will be december's top performers? Infrastructure stock boom to sweep.

Today, you can download 7 best stocks for the next 30 days. Rackspace (rxt) came out with quarterly earnings of $0.25 per share, beating the zacks consensus estimate of $0.24 per share. Zacks' 7 best strong buy stocks for december, 2021.

Et on zacks.com new strong sell stocks for september 21st Is based in san antonio. Investorsobserver gives rackspace technology inc (rxt) an overall rank of 40, which is below average.

Want the latest recommendations from zacks investment research? Want the latest recommendations from zacks investment research? Simply put, stocks with a zacks rank of 1, 2, or 3, with a positive esp were shown to positively surprise 70% of the time.

According to zacks, rackspace technology inc. Rxt investment & stock information. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

This suggests a possible upside of 49.6% from the stock's current price. Rackspace technology (nasdaq:rxt) was downgraded by zacks investment research from a buy rating to a hold rating in a report released on tuesday, zacks.com reports. This value represents a 214.29% decrease compared to the same quarter last year.

On average, they anticipate rackspace technology's stock price to reach $22.06 in the next twelve months. Rackspace technology (nasdaq:rxt) last announced its earnings results on monday, november 15th. Which is the better value stock right now?

We also note that rxt has a peg ratio of 1.09.

0 komentar:

Posting Komentar