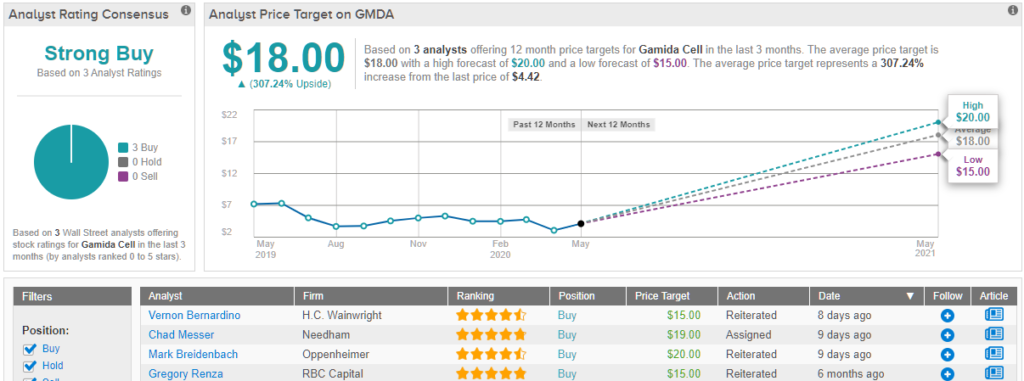

Rbc cuts price target on gamida cell to $11 from $14, citing setback to omidubicel fili. Previously, the target price had yet another raise to $15, while h.c.

According to analysts' consensus price target of $14.60, gamida cell has a forecasted upside of 518.6% from its current price of $2.36.

Gamida cell stock target price. According to the issued ratings of 5 analysts in the last year, the consensus rating for gamida cell stock is buy based on the current 5 buy ratings for gmda. The average gamida cell ltd stock price prediction forecasts a potential downside of n/a from the current gmda share price of $2.76. Gamida cell started at outperform with $15 stock price target at oppenheimer.

21, 2018 at 7:26 a.m. (gmda) stock quote, history, news and other vital information to help you with your stock trading and investing. The analyst firm set a price target for 12.00 expecting gmda to rise to within 12 months (a.

Amount of analyst coverage gamida cell has been the subject of 5 research reports in the past 90 days, demonstrating strong analyst interest in this stock. Stock forecast nasdaq:gmda price target and analyst ratings. Stock is down 50% over the past year.

In predicting price targets of as low as $11.00 and as high as $27.00, analysts are in agreement on assigning the stock over the next 12 months average price target of $17.57. The average price target is $14.6, which means analysts expect the stock to increase by 518.64% over the next twelve months. The new note on the price target was released on may 26, 2020, representing the official price target for gamida cell ltd.

Gamida cell's target price is an analyst's projection of its future price. Is set at 1.03 the price to book ratio for. Find the latest gamida cell ltd.

And even if the gmda’s share succeeded to reach the median price. Analyst price target on gmda. The average price target represents a 195.98% change from the last price of $4.73.

The latest price target for gamida cell ( nasdaq: On average, analysts give gamida cell ltd a strong buy rating. *the average price target includes all analyst analysis, not just the most recent analysis presented in the chart.

Gamida cell ltd (nasdaq:gmda) gamida cell ltd. Gmda) was reported by needham on november 16, 2021. Rbc cuts price target on gamida cell to $11 from $14, citing setback to omidubicel fili.

The average true range (atr) for gamida cell ltd. On average, wall street analysts predict that. The average price target is $14.00 with a high forecast of $14.00 and a low forecast of $14.00.

New target price is 340% above last closing price of us$3.31. Alliance global partners has the lowest price target set, forecasting a price of $11.00 for gamida cell in the next year. Hc wainwright has the highest price target set, predicting gmda will reach $22.00 in the next twelve months.

Needham analyst gil blum maintains gamida cell (nasdaq:gmda) with a buy and lowers the price target from $14 to $12. Based on 2 wall street analysts offering 12 month price targets for gamida cell in the last 3 months. That average ranking earns gamida cell ltd an analyst rating of 70, which is better than 70% of stocks based on data compiled by investorsobserver.

The price target was changed from $3.30 to 2.9%. Private updated dec 6, 2021 4:06 pm. Analyst opinions for gamida cell ltd.

Date rating action authority current price target price; Wainwright analysts kept a buy rating on gmda stock. Oppenheimer analyst mark breidenbach maintains gamida cell (nasdaq:gmda) with a outperform and lowers the price target from $17 to $15.

— stock price and discussion | stocktwits. Price targets can be assigned to all types of securities, from complex investment products to stocks such as gamida cell and even bonds. Gamida cell ltd's share price could stay at $13.67 by nov 16, 2022.

If the target price is unavailable, it is most likely because there were not enough analyst opinions to come up with a consensus estimate. The company is forecast to post a net loss per share of us$1.43 next year compared to a net loss per share of us$1.66 last year.

0 komentar:

Posting Komentar