A bull trap denotes the opposite of this phenomenon, in which the reversal of a declining trend is falsely signaled. The stock then continues to the upside, forcing many of the shorts to cover.

These are unexpected movements that can incur great losses to traders if they are not careful.

Bear trap stock term. Second, the entry would confirm the bullish pattern known as a bear trap. This phenomenon results from short selling or overleveraging by a brokerage firm. A bull trap denotes a bearish reversal.

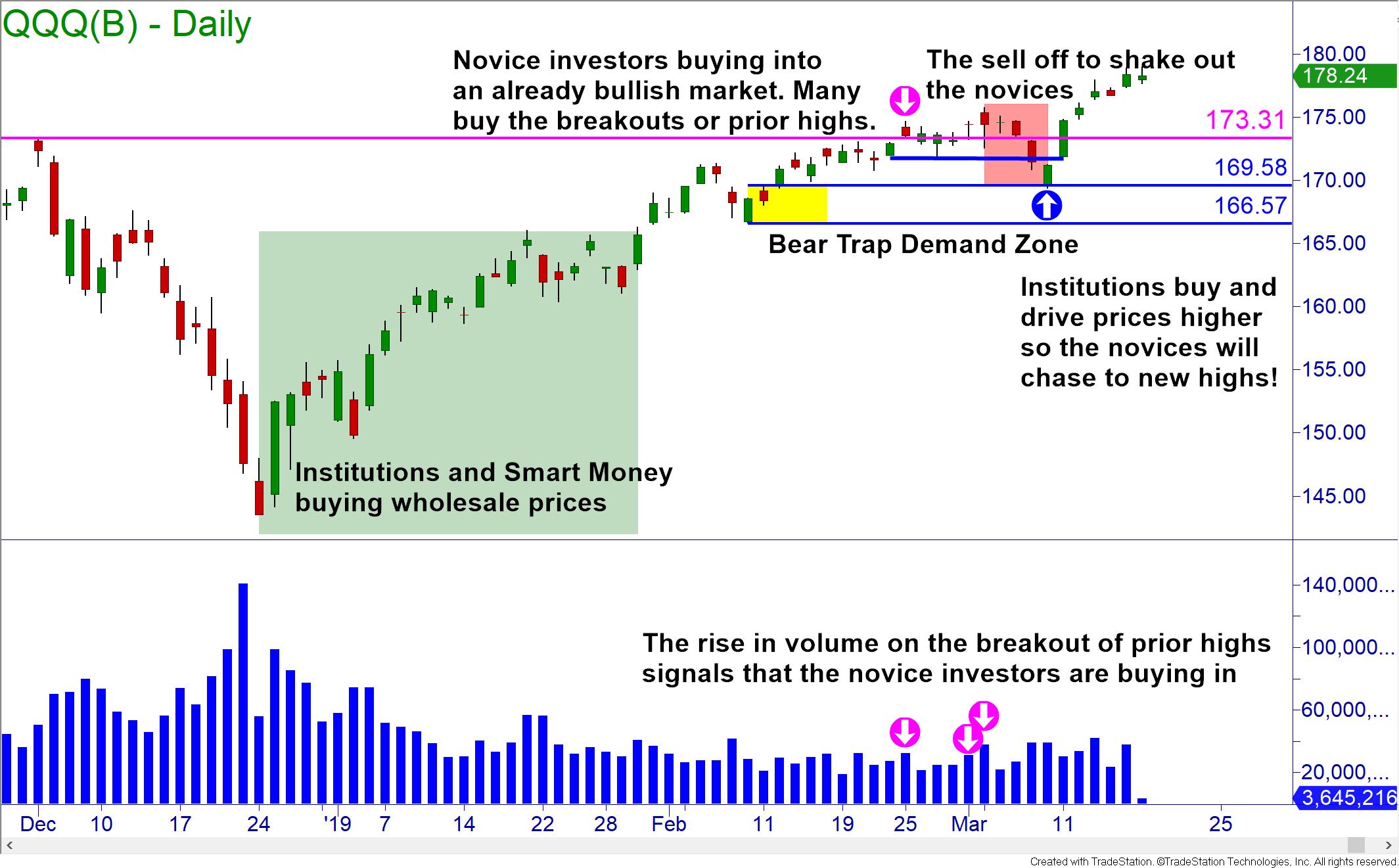

Bear trap stocks are ones that have already fallen a lot in price and traders continue to sell it short believing it will continue to fall and make lower and lower prices. Bull traps and bear traps are forms of the whipsaw pattern, which describes the movement of stocks in a volatile market where the stock suddenly switches direction. Bull traps occur when buyers fail to support a rally above a breakout level.

A false signal which indicates that the rising trend of a stock or index has reversed when in fact i A bear is an investor who believes that a particular security, or the broader market is headed downward and may attempt to profit from a decline in stock prices. What is bear trap in trading?

This occurs when sellers fail to press a decline below a breakdown level. Breaks the support level and closes below it; However, in this context, the term is used to describe both the technique and the specific technical indication of a reversal in a market downtrend.

A bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. This stock is in bear trap. One such trap is the bear trap in stocks.

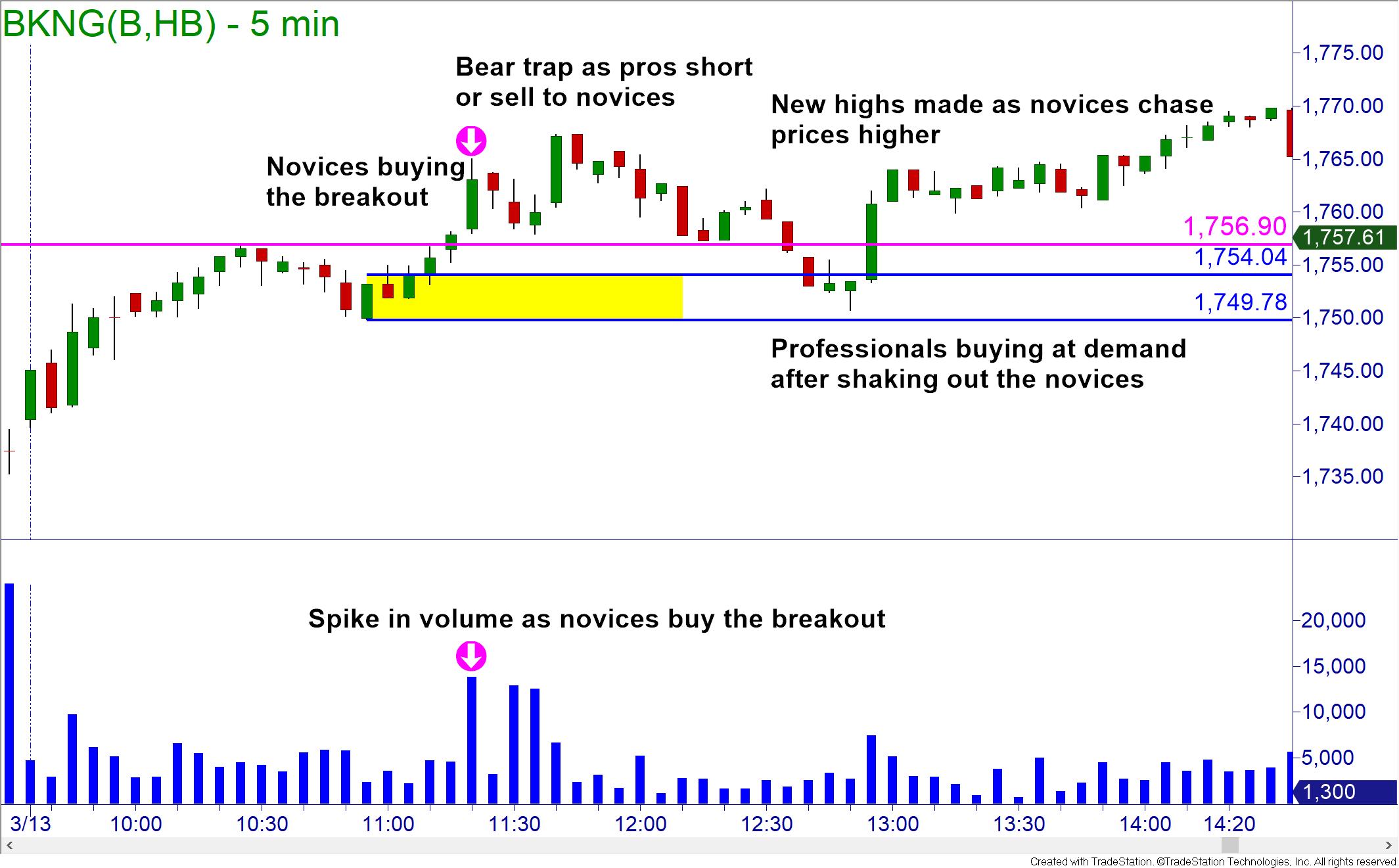

I see it going below 130 in next 3 months. A bear trap, in terms of trading, is a strategy that institutions use to take advantage of the young traders that don’t have the insight to recognise when they are being played. In this post, i will make a lot of mention about the bear trap candlestick.

This is the definition of the bear trap candlestick. A bear trap is a market pattern that occurs when the performance of a cryptocurrency exhibits false signals of a reversing upward price trend. Market participants on the wrong side of the price action must exit positions with unexpected losses.

Essentially, the bear trap is designed to encourage investors to buy at a higher price, with the anticipation that during the upswing the unit price will exceed the rate that was paid for the shares. Traders look for bearish patterns such as bear flags or bear pennants so that they can take a short position on it and get paid when the stock drops in value. A bear trap denotes a technical pattern that occurs when the performance of a stock, index or other financial instrument incorrectly signals a reversal of a rising price trend.

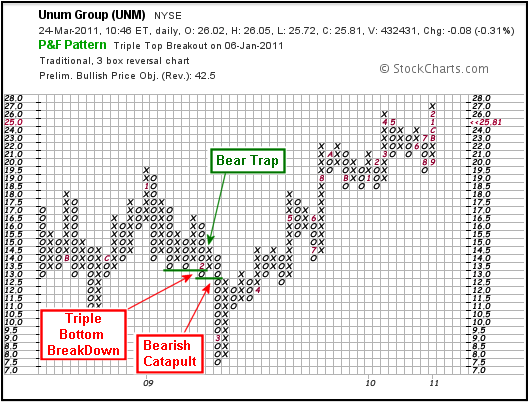

First, the entry breaks the bear market angle and converts the point and figure chart into a bull market. In other words, the price action of the asset tricks some investors into believing that the price is on the decline. An accumulation of shares being sold short by bears trying to drive down the price of a stock.

For example, when there are a. Bear traps most often occur in strongly trending stocks. Bear trap trading is taking a bearish position on a stock because you believe it’s going to go down.

After the trap, the price of the cryptocurrency rises rapidly, leaving bearish traders. It consists of creating a false signal in the market, indicating that an asset is going to start losing its value. When shares in an uptrend suddenly fall, a bear trap often follows.

As the name itself suggests, a bear trap is basically a situation when forex traders think that a support level is breaking and so as soon as price moves below the support level, they start selling due to the supposed breakout. Fundamentals are very weak and even management is very poor. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

Moneycontrol contributor november 08, 2021 / 07:15 am ist The value of the coin then rebounds, and the trap setters have made a profit.bear traps originated on the stock market. It is a term in the stock trading where the expected downwards movement of share prices immediately reverses upwards.

Or break the support level but that closes above. Markets move higher because of an imbalance between buying and selling pressure. Bear traps occur when investors bet on a stock’s price to fall but it rises instead.

What is a bear trap? A bear trap candlestick is the candlestick that either: What is a bear trap?

0 komentar:

Posting Komentar