Bp and exxon mobil are both sporting a zacks rank of # 1 (strong buy) right now. This signals that analyst sentiment is.

The company had reported earnings of 76 cents per share a year.

Bp stock forecast zacks. Both bp and xom are impressive stocks with solid earnings outlooks, but based on these valuation figures, we feel that bp is the superior value. Rkt as the bull of the day, zscaler, inc. Annual revenue (last year) $180.4b:

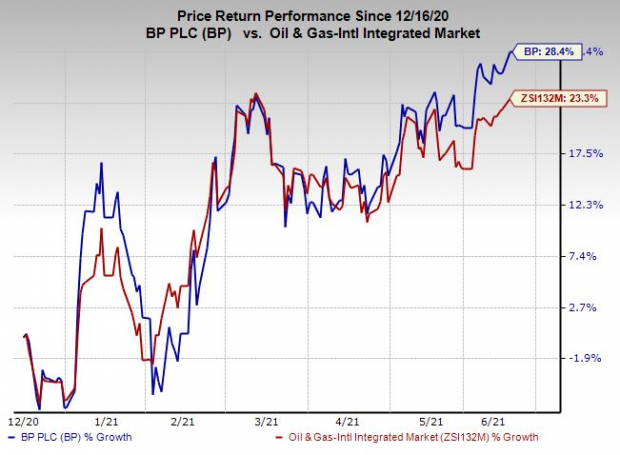

Bp plc bp has witnessed upward earnings estimate revisions for 2021 and 2022 in the past 30 days. Eps forecast (this quarter) $1.12: Bp is currently sporting a zacks rank of #1 (strong buy).

Exxon mobil, chevron, bp and eni. The stock, sporting a zacks rank #1 (strong buy), is likely to see earnings growth of 323.1% this. Zs as the bear of the day.

They currently have a $29.00 price target on the oil and gas exploration company's stock. Investors should feel comfortable knowing that both of these stocks have an improving earnings outlook since the. In addition, zacks equity research provides analysis on bp plc bp, royal dutch shell plc (rds.a) and eni spa e.

Bp is currently sporting a zacks rank of #2 (buy). Halliburton, kinder morgan, schlumberger, equinor, bp and conocophillips. Zacks investment research's price target suggests a potential upside of 7.77% from the company's previous close.

Free stock analysis report schlumberger limited (slb) : Here is a synopsis of all five stocks: For the bp plc forecast (traded under symbol bp) for one year forward price target at the top of this page, we have presented the average bp forecast for forward target price across the 10 analysts covering bp, as reported in data provided by zacks investment research via quandl.com.

This means that analyst sentiment is stronger and the stock's earnings outlook is improving. The zacks consensus estimate is profit of 12 cents per share.

0 komentar:

Posting Komentar