10 or 15 minute delay, ct. Tomorrow only, buy 5 cents above today's high and risk 1 point.

A bull flag is a consolidation after a strong upmove.

Bull flag stocks today. I say it all the time: After breaking from the larger bull flag created between july 28 and aug. You can move the plots on the x and y axis in the settings for the daily, weekly and monthly tfs.

They exist today, of course, but just where they will go, and what they will look like in a century, are simply unknowable. A bullish flag pattern occurs when a stock is in a strong uptrend, and resembles a flag with two main components: Free swing trade stock watch lists.

There are some things we do know. If tesla’s stock can trade above the resistance at $718, it has room to move up to fill the gap between $768.50 and $777.37. After rocketing from the $80 range up through $133, the stock began to stall and consolidate.

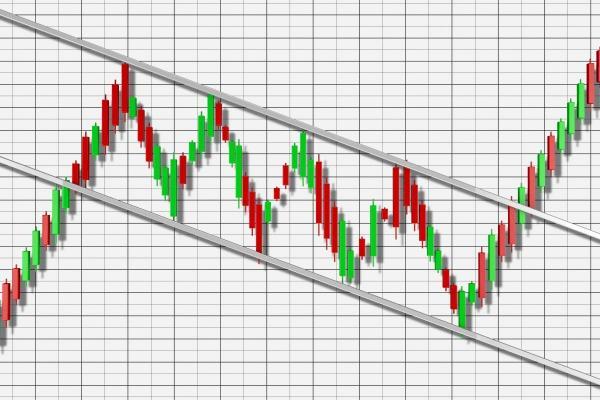

Its implied volatility rank sits at a lowly 13%, making bull call spreads an attractive idea. The uptrend may continue when the stocks moves out of the consolidation zone. While the lines are sloping down, they should remain relatively parallel to each other.

Over the last two weeks, sand has seen some consolidation after a massive run up in the four weeks prior to that. Therefore, a bull flag is a relatively rare bullish chart pattern. Also promoter bought shares of worth 10 crores between 22 nov to 2 dec at average price 688.70 rs/share.

Why tesla stock is trading lower today what's a. As mentioned earlier, the bull flag is a continuation pattern. The starting points for the trend lines should connect the highest highs (upper trend line) and the highest lows (lower trend line) to represent the flag portion.

An aggressive uptrend that resembles a flag pole and a consolidation or correction lower that takes place within two parallel trend lines. The second step in spotting the bull flag pattern is monitoring the shape of the correction. A bullish flag pattern typically has the following features:

When trading penny stocks, it is essential to identify consolidation and continuation. With sand bouncing off the lower support earlier today, i think that the pattern has been confirmed and that we're going to follow this. Buy the dec $180/$190 bull call spread for around $4.30 if the stock triggers.

Chwy) broke up from a bull flag pattern on the daily chart that benzinga called out the trading day prior. This pattern is a bullish continuation pattern. Fundamentals, technical, and sentiment mostly favorable for gold and silver.

The plots are aligned on their mid cycles to the 2021 mid cycle. Spotting the bull flag pattern. The formation consists of two key phases:

Stay till end of the day. We’ll see lower highs but constant lows forming a flag, meaning we won’t see “lower. This can be as short as a few hours to as long as a few days.

This script plots 2 lines which are the 2013 and 2016 bull run. The pole and the flag. Use a trailing stop and stay in the position until you are stopped out.

“look for the pattern.” so today, i’ll break down the bull flag. The stock has since consolidated the move by trading sideways. In the chart below, we see gbp/usd price movements on a daily basis.

Smart traders know key patterns — and the bull flag pattern can be a crucial momentum indicator. Bullish flag breakout in meghmani finechem limited. The bullish bears team posts a swing trade stock watch list free everyday by 9 pm est, so make sure to bookmark this page and check it daily.

Precious metals have shown resilience despite rising yields and strengthening dollar. The stock then shot up 19% higher over the following six. 22, amd shot up almost 4%.

The bull flag is a continuation chart pattern that ultimately helps the uptrend to continue. The plot is weird on the monthly tf, best to use the daily and weekly. A bull flag pattern is a chart pattern that occurs when a stock is in a strong uptrend.

Our swing “trade alert setups” provide you with potential key breakout and breakdown areas. We also include our swing trading alert “setups” for our community members. This screen finds bull flag patterns.

It is called a flag pattern because when you see it on a chart it looks like a flag on a pole and since we are in an uptrend it is considered a bullish flag.

:max_bytes(150000):strip_icc()/Clipboard04-04f8217269aa464ca5694333cb77d443.jpg)

0 komentar:

Posting Komentar