Investors are deciding to sell shares today as doubt. No analyst has a sell recommendation.

Here is a look at the average analyst rating for the stock as represented on a scale of 1.00 to 5.00, with the extremes of 1.00 and 5.00 suggesting the stock is strong buy or strong sell respectively.

Fortuna silver mines stock buy or sell. There are plenty of mining stocks to watch despite what some may think. Since then, fvi stock has increased by 14.8% and is now trading at c$4.18. Fortunately, there are plenty of other silver and gold stocks to consider.

Fortuna silver mines share dividends. The stock has been going down all year and it got slaughtered at the end of the week losing 21% in two days. So let’s have a look at four mining stocks that could rise in 2021 if things go right.

Est, shares are down 15.6%, having recovered slightly from their 17% decline earlier in the trading session. Geode capital management llc grew its stake in fortuna silver mines by 26.8% in the 1st quarter. Its net profit is forecast to double by 2025, and it is currently operating with a gross profit margin of 42.90%, higher by the sector median by 40.65%.

Zacks investment research raised fortuna silver mines from a sell rating to a hold rating in a research note on tuesday. 3 › » next page. 1w 1m 6m 1y interactive chart oct 25, 2021, 8:00 pm 0 showing 16 to 30 of 36 entries previous page « ‹ 1;

3 › » buy fortuna silver. Fortuna silver mines is a precious metals exploration, extraction, and processing enterprise. 0.20 (3.29%) 1d financials technical analysis buy, sell or hold?

Geode capital management llc now owns 43,338 shares of the basic materials company's stock worth $281,000 after buying an additional 9,167 shares in the last quarter. While the price of silver is up nearly 6% so far in november, investors aren’t recognizing fortuna silver mines (nyse: On average, they anticipate fortuna silver mines' stock price to reach $7.94 in the next year.

Pan american silver is a canadian company from vancouver operating mines in canada and central and latin america. Its principal assets are the cayloma and san jose mines, while it also administers the lindero gold project. Press release reported on 06/18/21 that iss and glass lewis recommend fortuna and roxgold shareholders to vote in favor of proposed.

A popular way to gauge a stock's volatility is its beta. Is fortuna silver mines stock a good buy in 2021, according to wall street analysts? Top mining stocks to buy or sell.

Out of 3 analysts, 1 ( 33.33% ) are recommending fsm as a strong buy, 0 ( 0% ) are recommending fsm as a buy, 1 ( 33.33% ) are recommending fsm as a hold, 0 ( 0% ) are recommending fsm. Fortuna silver's stock options are financial instruments that give investors the right to buy or sell shares of fortuna silver mines common stock at a specified price for a given time period. The company’s stock price has collected 12.88% of gains in the last five trading sessions.

1w 1m 6m 1y interactive chart nov 22, 2021, 9:00 pm 0 showing 31 to 36 of 36 entries previous page « ‹ 1; 19, 2021 at 3:10 p.m. Also, there is a general sell signal from the relation between the two signals where the.

6 analysts recommended to buy the stock. Fortuna silver mines (fsm) was upgraded to a hold rating at canaccord genuity nov. Fortuna silver mines share price volatility.

48 rows how much insider buying is happening at fortuna silver mines?. Nyse fsm opened at $3.96 on friday. Fsm ) stock is to hold fsm stock.

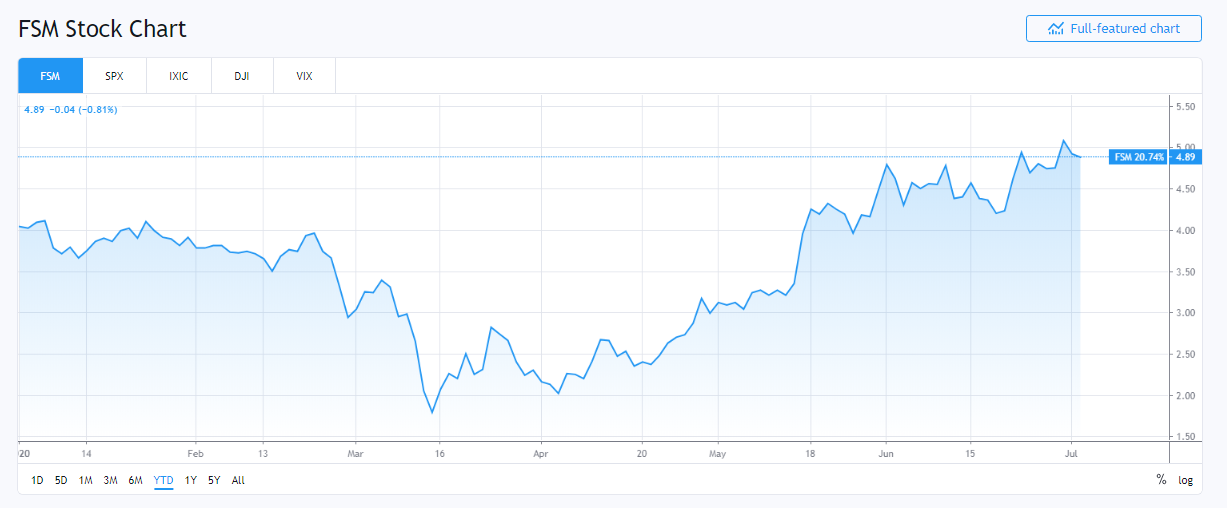

0.01 (0.21%) 1d financials technical analysis buy, sell or hold? Generally speaking, an option to purchase or sell fortuna stock makes it part of the underlying stock when the option's price is tied to the movement of the underlying stock. Over the last 12 months, fortuna silver mines's shares have ranged in value from as little as $3.39 up to $9.85.

The firm is on the lookout for silver, gold, zinc, and lead deposits. (click on image to enlarge). Harmony gold mining company limited ;

Their forecasts range from $6.50 to $9.00. This suggests a possible upside of 143.5% from the stock's current price. Finally, national bank financial reduced their price objective on fortuna silver mines from c$7.00 to c$6.50 and set a sector perform rating for the company in a research note on monday.

Fsm) as a very lustrous option today. The following is my case for buying fortuna silver mines (fsm) stock. Looking at the stock’s medium term indicators we note that it is averaging as a 100% sell, while an average of long term indicators are currently assigning the stock as 100% sell.

Get the hottest stocks to trade every day before the market opens 100%. The consensus among 3 wall street analysts covering ( nyse : We're not expecting fortuna silver mines to pay a dividend over the next 12 months.

0 komentar:

Posting Komentar