But 5 days ago it was around $8 per share. Bull 2x shares etf (gush) stock.

Overall ranking is a comprehensive evaluation.

Is gush stock a good investment. Bull 2x shares (gush) etf bio. Gush's 51 means that it ranks higher than 51% of stocks. Etfs are subject to management fees and other expenses.

I bought 1 share of gush because it's all i could afford for now. Completely new to the stock market. Gush's leverage factor only amplifies the potential for volatility.

Was going to liquidate gush 11600 units at $122, but after these bullish numbers, i've upped the sell order to $137.90. Since 1988 it has more than doubled the s&p 500 with an average gain of. The investment seeks daily investment results, of 200% of the daily performance of the s&p oil & gas exploration & production select industry index.

Been an amazing ride since jan. This stock will make you money! The fund normally creates long positions by investing at least 80% of its assets in the securities that comprise the index and/or financial instruments that provide leveraged and unleveraged exposure to the index.

During the day the stock fluctuated 6.29% from a day low at $50.36 to a day high of $53.53. Why is this one falling so hard? Its trading at.84 per share at time of this writing.

Since this share has a negative outlook we recommend looking for other projects instead to build a portfolio. It considers technical and fundamental factors and is a good starting point for evaluating a stock. Unlike mutual funds, etf shares are bought and sold at market price, which may be higher or lower than their nav, and are not individually redeemed from the fund.

The fund creates short positions by investing at least 80% of its assets in swap agreements; I know how greedy and corrupt america is when it comes to their oil, so surely there is a lot of money to be made if i invest during this recession. (mfa financial analysis chart) by silent investor.

There was a massive volume of almost 104 million shares in the etf on monday, compared to 22 million shares on friday. I'm thinking of spending it on oil due to how it has plummeted and how its basi8worth nothing now. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the.

Since then, gush stock has increased by 11,838.5% and is now trading at $86.53. Use these links to get 3 free stocks! Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

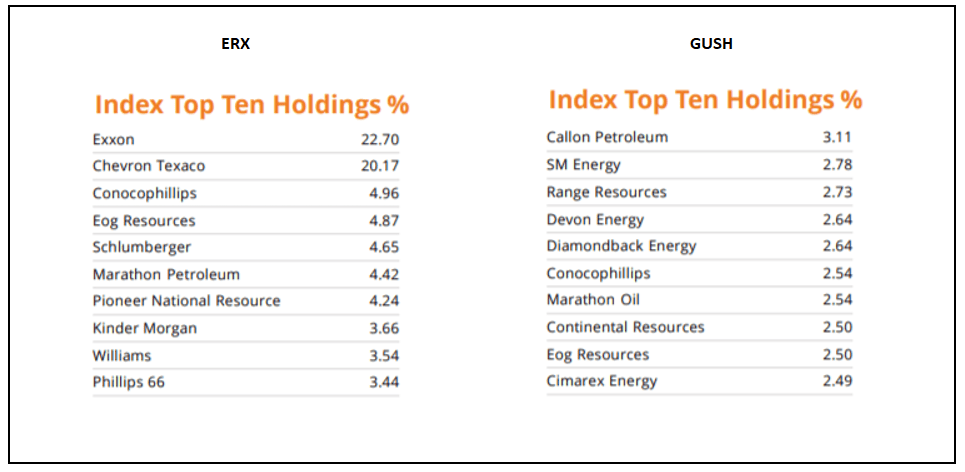

Bull (gush) and bear (drip) 2x shares seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite), of the performance of the s&p oil & gas exploration & production select industry index. Stockchase rating for direxion daily s&p oil & gas exp & prod bl 3x shs is calculated according to the stock experts' signals. What's going on with gush ?

Our ai stock analyst implies that there will be a negative trend in the future and the gush shares are not a good investment for making money. The investment seeks daily investment results, of 300% of the performance of the s&p oil & gas exploration & production select industry index. Options on securities and indices;

Gush represents a leveraged move in one of the most volatile stock market groups. The investment seeks daily investment results, of 300% of the performance of the s&p oil & gas exploration & production select industry index. Given the massive loss of gush, many wall street insiders are asking themselves if this is the end of leveraged etfs for retail investors.

The proshares ultra bloomberg natural gas stock price gained 10.03% on the last trading day (tuesday, 23rd nov 2021), rising from $47.96 to $52.77. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to. The direxion daily s&p oil & gas exp.

Etfs are subject to market fluctuation and the risks of their underlying investments.

0 komentar:

Posting Komentar