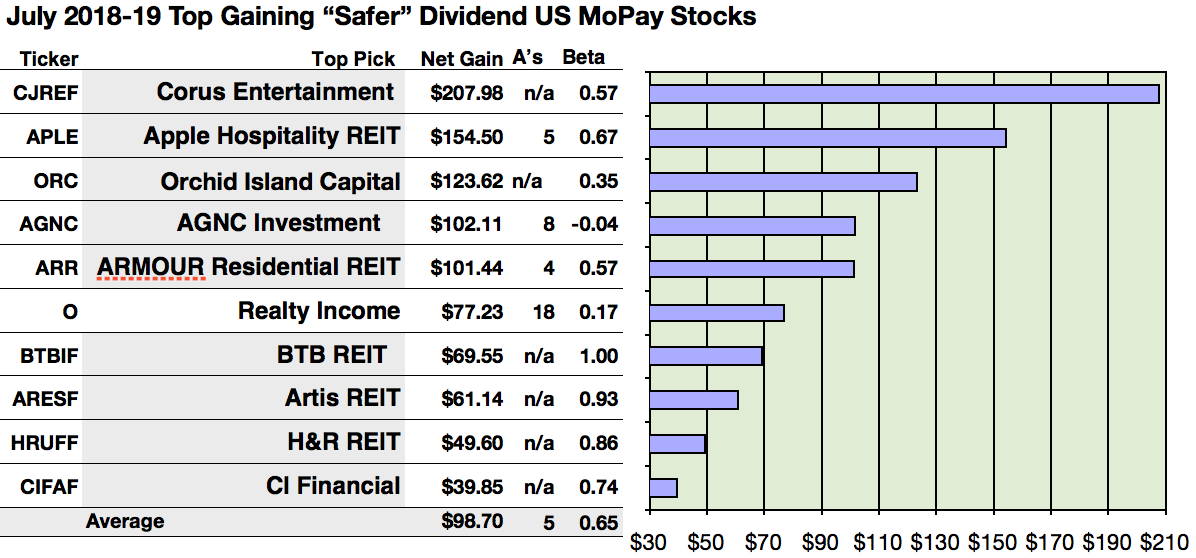

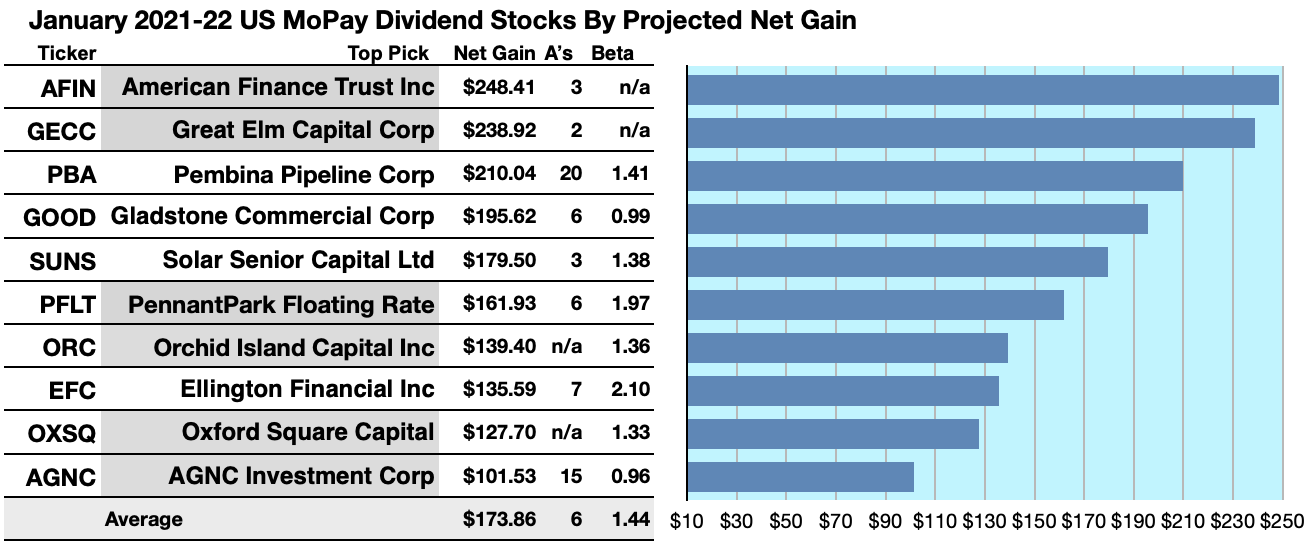

Companies with similar return on investment at sep 30 2021, within financial sector: The current dividend payout for stock orchid island capital, inc.

Payout ratio (fwd) fwd payout ratio is used to examine if a company’s earnings can support the current dividend payment amount.

Orc stock dividend payout ratio. (nyse:orc) by 424.8% in the second quarter, according to its most recent 13f filing with the securities and exchange commission. Fundamental and financial data for stocks, sector, industry, and economic indicators. Latest dividend payout is the % of net income paid to stockholders in dividends.

The forward dividend yield for orc as of dec. Orchid island capital’s dividend payout ratio is 65.00%. 2, 2021 is 0.78 usd.

The date on which the next dividend is estimated to be paid. However, orc has been paying out that 8 cents per quarter since mid. 81.25% based on next year's estimates ;

This stock pays an annual dividend of $0.78, which amounts to a dividend yield of 16.25%. Orchid island capital has only been increasing its dividend for 1 years. That has also culminated in orc’s dividend being cut from 14 cents per quarter in the past to the current 8.

On the beginning of the month and end of the. That generates a yield rate of 16.5%, which would be considered very. Best dividend capture stocks in nov.

December 1, 2021 7:58 pm est. Orchid island capital inc (orc) dividend data. Shareholders on record as of this date are entitled to any dividend paid.

Orchid island capital currently has a short interest ratio of 2.0. An institutional investor recently raised its position in orchid island capital stock. 108 rows dividend history | orc orchid island capital inc.

There are typically 12 dividends per year (excluding specials). Average dividend growth rate for stock orchid island capital, inc. Orchid island pays out a dividend of $0.08 per share per month, which calculates to an annualized payout of $0.96 per share.

Common stock (orc) nasdaq listed. That’s because when you get past their savory 15.89% dividend yield you find a sour history of earnings decline. A short interest ratio of 10 or greater indicates strong pessimism about a stock.

Based on eps estimates, orchid island capital will have a dividend payout ratio of 81.25% in the coming year. It divides the forward annualized dividend by fy1 eps. The historical rank and industry rank for orchid island capital's dividend payout ratio or its related term are showing as below:

Last dividend payout / amount. A short interest ratio ranging between 1 and 4 generally indicates strong positive sentiment about a stock and a lack of short sellers. This metric is important for investors wanting a significant dividend outlook for a particular investment.

This calculates to a quarterly dividend distributions payout ratio of 92%, 120%, 147%, and 186%, respectively (see red reference “(i / e)”). The dividend payout ratio of orchid island capital inc is 4.31, which seems too high. The next orchid island capital inc dividend went ex 4 days ago for 6.5c and will be paid in 26 days.

93.64% based on cash flow 81.25% based on this year's estimates ; If nly is the safe pick…then orc is the risky one.

+0.01 (+0.2%) data as of oct 29, 2021. (orc) for past three years is. The previous orchid island capital inc dividend was 6.5c and it went ex 1 month ago and it was paid 7 days ago.

Intraday data delayed 15 minutes for nasdaq, and other exchanges. 117 rows the dividend payout ratio for orc is: Morgan stanley grew its position in orchid island capital, inc.

Cash dividend payout ratio definition cash dividend payout ratio measures the amount of cash dividends that a company pays out in comparison to their total cash flow available to shareholders. Data is currently not available. Learn more on a good short interest ratio for orchid island capital

0 komentar:

Posting Komentar