Share is performing relatively much better than most of its peers within the same industry. The current romeo power inc share price is $3.57.

On average, wall street analysts predict that.

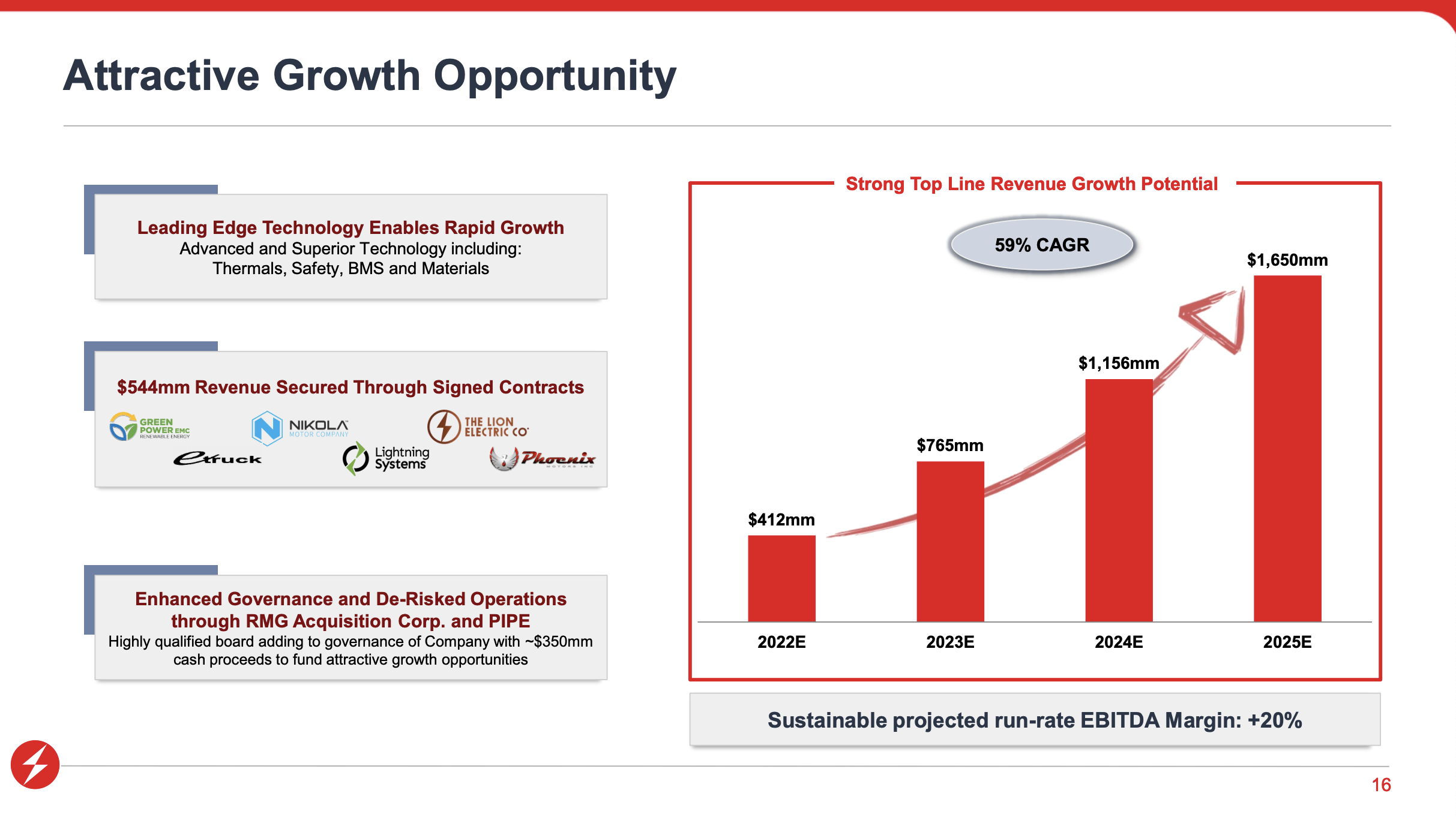

Romeo power stock forecast. The stock lies in the middle of a very wide and falling trend in the short term and further fall within the trend is signaled. Romeo power forecasts 2022 revenues will only top $400 million. Annual revenue (last year) $9.0m:

Based on 2 wall street analysts offering 12 month price targets for romeo power in the last 3 months. The company’s new ceo has substantial experience in the auto and energy industries, specifically when ramping up production. Their forecasts range from $4.00 to $9.00.

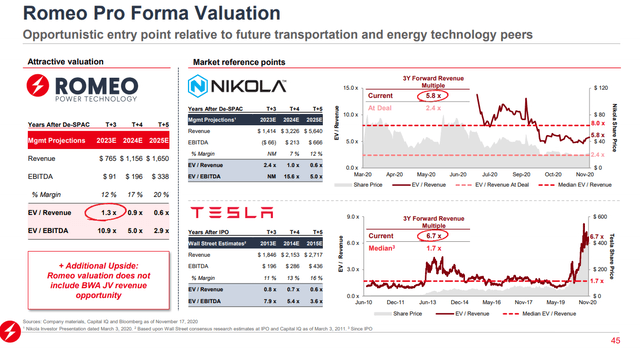

7:31a tesla stock price target raised to $1,400 from $1,100 at wedbush Through its suite of advanced hardware, combined with its innovative battery management system, romeo power delivers the safety, performance and reliability its customers need to succeed. With romeo power inc.’s stock down over 50% since it went public, investors my be worried.

Romeo power is an energy technology leader delivering advanced electrification solutions for complex commercial vehicle applications. From ai system, total return is 3106.83% from 2918 forecasts. Volume has increased on the last day along with the price, which is a positive technical sign.

This suggests a possible upside of. Rmo romeo power — stock price and discussion | stocktwits. (rmo) estimates and forecasts data shows that the romeo power inc.

The average romeo power stock price prediction forecasts a potential downside of n/a from the current rmo share price of $3.81. Summary of all time highs, changes and price drops for romeo power; Romeo power inc stock forecast.

Share is performing relatively much better than most of its peers within the same industry. The score for rmo is 25, which is 50% below its historic median score of 50, and infers higher risk than normal. Romeo power stock has been on a steady downtrend since it got listed after its reverse merger with rmg acquisition spac in december 2020.

Analyst estimates, including rmo earnings per share estimates and analyst recommendations. Can romeo power stock rebound from its recent fall? According to analysts, romeo power's stock has a predicted upside of 11.42% based on their 12.

Does romeo power's stock price have much upside? For romeo power stock forecast 2022, 12 predictions are offered for each month of 2022 with average romeo power stock forecast of $3.8, a high forecast of $4.03, and a low forecast of $3.6. The $384 million cash injection from the spac merger is going to “provide capacity expansion and r&d to further develop the next generation of battery system technologies for commercial vehicles”.

On average, they anticipate romeo power's stock price to reach $5.93 in the next twelve months. The average price target is $6.50 with a high forecast of $9.00 and a low forecast of $4.00. Romeo power inc stock price forecast for 2022:

Est on tuesday, shares of romeo power are up 16%, having given back some of the 25% rise that they experienced earlier this morning. Romeo power's share price could stay at $12.50 by mar 31, 2022. The financial story becomes impressive once reaching 2023 where revenues.

Firstly, the year ahead for romeo power marks a new chapter for the ev battery innovator. Romeo power nyse updated dec 4, 2021 12:48 am. Is romeo power inc stock undervalued?

The average price target represents a 64.56% change from the last price of $3.95. Data shows that the romeo power inc.

0 komentar:

Posting Komentar