A stock market bubble—also known as an asset bubble or a speculative bubble—is when prices for a stock or an asset rise exponentially over a. In bubble scenarios, the stock market always corrects violently.

In economic terms, a stock market bubble is occurring when stock prices have increased significantly without any corresponding increases in the.

Stock market bubble meaning. The general definition of a bubble would then simply be: An economic bubble, also known as a market bubble or price bubble, occurs when securities are traded at prices considerably higher than their *intrinsic value, followed by a ‘burst’ or ‘crash’, when prices tumble. The stock market risk premium is completely integrated with the valuation you pay and valuation matters in the long term.

What does stock market bubble mean? The story began easily enough, if not with “once upon a time.”. The sudden appearance of the virus, its rapid spread, and.

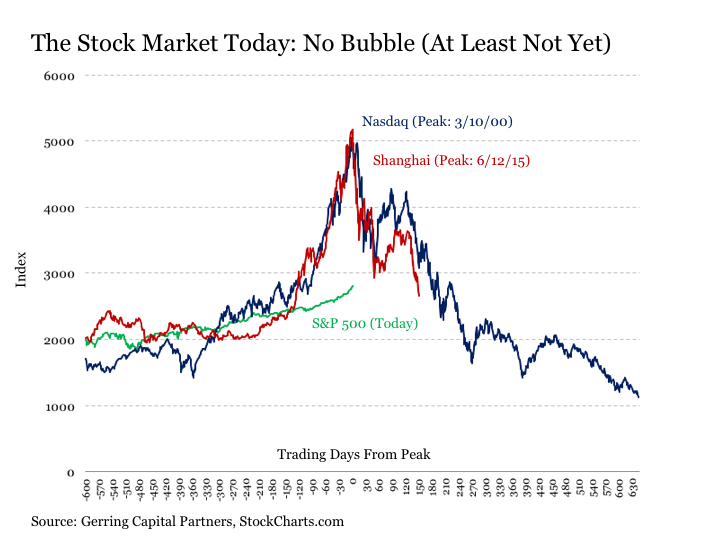

The dotcom bubble was an economic bubble that affected the prices of stocks related to the technology industry during the late 1990s and early 2000s in the united states. This episode originally ran in 2013. A stock market bubble is a type of economic bubble in which an exaggerated bull market where the value of stocks listed on a stock exchange rise dramatically upon a wave of public enthusiasm.

Typically prices rise quickly and significantly, growing far beyond their previous value in a short period of time. Either stock values will come down, or they will remain stagnant for a number of years for earnings to catch up. “there is a bubble if the (real) price of an asset first increases dramatically over a period of several months or years and then almost immediately falls dramatically.” (lind 2009, p.

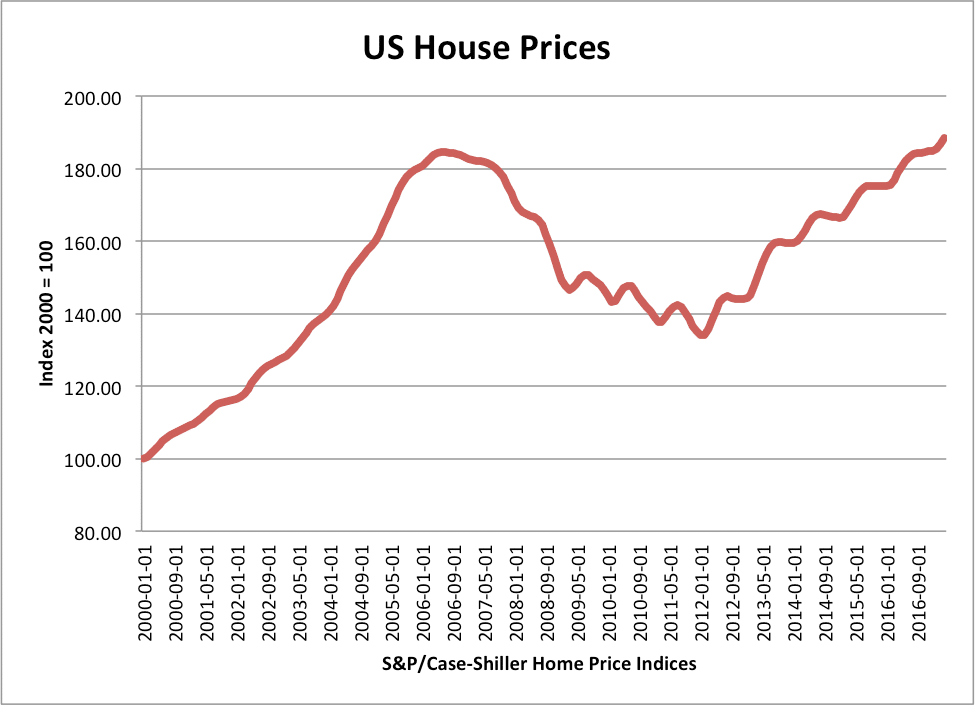

The term is commonly used when talking about the property market (housing bubble). When they fall, they do so quickly and often below the starting value. In 2013, yale economist robert shiller was asked if he would accept the nobel memorial prize for.

A stock market bubble is a period of growth in stock prices followed by a fall. In simpler terms, it’s an overheated market (whether it be stocks, bonds, real estate, commodities, technology, etc.) where too many investors become overly eager to buy. A news search of dotcom bubble — a reference to 2002 when markets fell nearly 80 per cent from their peak, reveals a flurry of recent hits.

Every stock market bubble begins with a story, and make no mistake—this is a stock market bubble. Additional meaning of stock market bubble: Stock screener for investors and traders, financial visualizations.

Stock market bubbles involve equities—shares of stocks that rise rapidly in price, often out of proportion to their companies' fundamental value (their earnings, assets, etc.). Economists define a bubble as an economic cycle characterized by rapid expansion, followed by a contraction.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Irrational_Exuberance_Jan_2021-01-45e4d7c38e1f47f290063b49bf234f9a.jpg)

0 komentar:

Posting Komentar