Annual revenue (last year) $1.3b: Share prices are performing particularly well compared to other companies within the same industry.

(sxc) stock forecast based on top analyst's estimates, plus more investing and trading data from yahoo finance

Suncoke energy stock forecast. Sxc) suncoke energy's forecast annual earnings growth rate of 31.17% is forecast to beat the us basic materials industry's average forecast earnings growth rate of 28.46%, and and it is also forecast to beat the us market's average forecast earnings growth rate of 19.23%. Saw domestic coke production rise almost 19% in the third quarter and maintained its production guidance for 2021. The stock is moving within a wide and horizontal trend and further movements within this trend can be expected.

Suncoke energy stock forecast, sxc stock price prediction. Annual profit (last year) $3.7m: Monthly and daily opening, closing, maximum and minimum stock price outlook with smart technical analysis

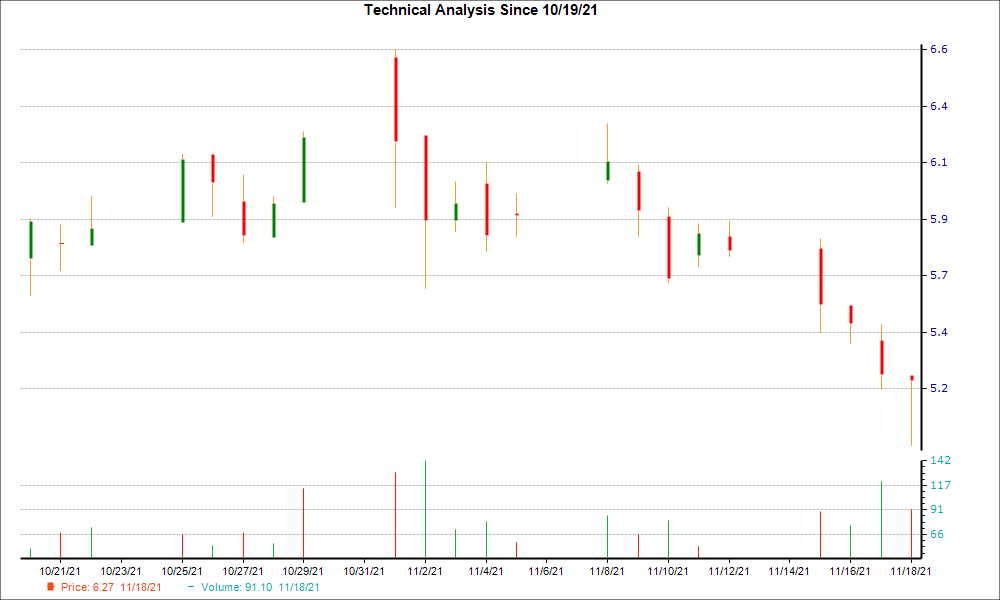

(sxc) projections and forecasts suncoke energy, inc. Based on the suncoke energy inc stock forecasts from 1 analysts, the average analyst target price for suncoke energy inc is usd 10.00 over the next 12 months. The stock is moving within a wide and horizontal trend and further movements within this trend can be expected.

Et by tomi kilgore suncoke lifts guidance thanks to higher margin, volume at. A break of a horizontal trend is often followed by a large increase in the volume, and. Suncoke energy inc operates as an independent producer of coke in the americas.

Find the latest suncoke energy, inc. Eps forecast (this quarter) $0.22: The company’s revenue is forecast to grow by 14.70% over what it did in 2021.

As is evident from the statistics, the company’s shares have risen +112.29 percent over the past six months and at a 5000% annual growth rate that is well above the. Find the latest news for suncoke energy inc stock on our page and stay on top of the game. A company’s earnings reviews provide a brief indication of a stock’s direction in the short term, where in the case of suncoke energy inc.

Earnings for suncoke energy partners are expected to grow by 20.00% in the coming year, from $1.60 to $1.92 per share. The p/e ratio of suncoke energy partners is 10.17, which means that it is trading at a less expensive p/e ratio than the market average p/e ratio of about 14.62. According to analyst projections, sxc’s forecast low is $9.00 with $10.00 as the target high.

Domestic coke production climbed to. From the analysts’ viewpoint, the consensus estimate for the company’s annual revenue in 2021 is $1.53 billion. The average price target is 9.69 usd with a high forecast of 10.5 usd and a low forecast of 9.09 usd.

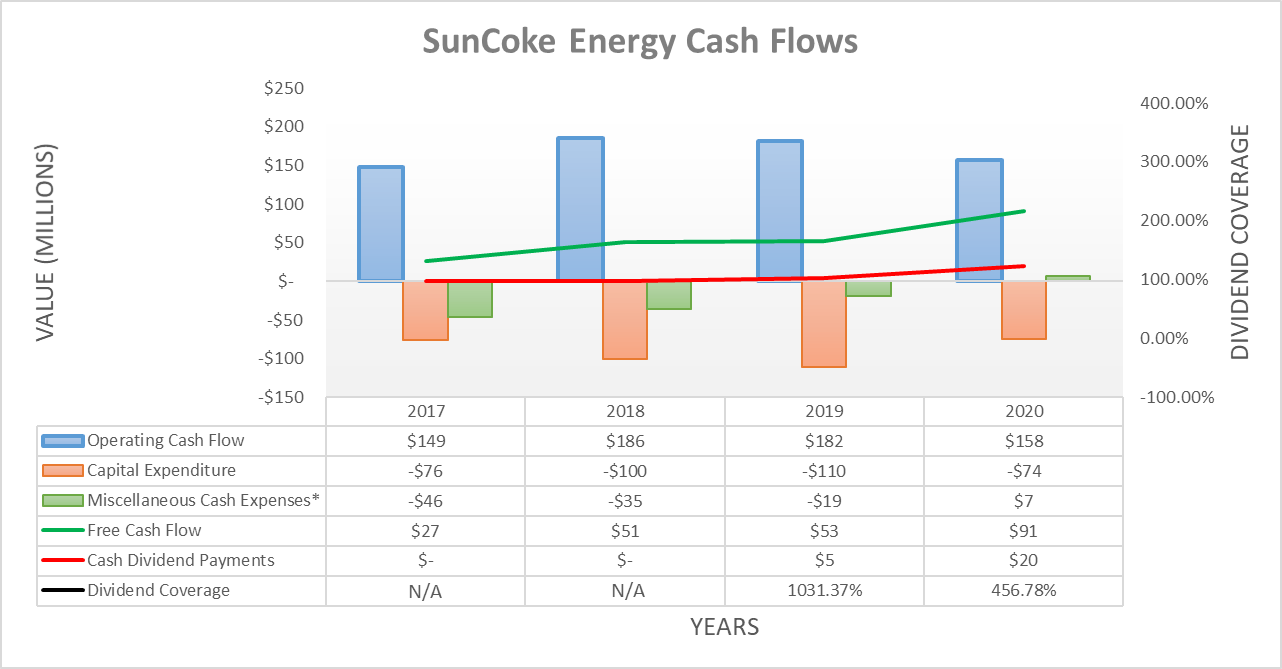

Suncoke energy has seen a strong third quarter of 2021 after an equally strong second quarter that at the time saw their guidance raised. Suncoke energy stock price target raised to $9 from $8 at benchmark aug. Suncoke energy stock was originally listed at a price of $17.00 in jul 21, 2011.

Price to earnings ratio vs. Suncoke energy inc (sxc) gets an overall rank of 50, which is an above average rank under investorsobserver's stock ranking system. A break of a horizontal trend is often followed by a large increase in the volume, and stocks seldom manage to go.

Price target in 14 days: 12 month price targets for sxc stock made by wall street analysts. 2, 2021 at 6:53 a.m.

0 komentar:

Posting Komentar