Below are a few of the sample screeners created: The stock may not make any meaningful moves upward, but the bottoming formation should act as a new support level.

Chartink plans live charts for nifty and nifty 50 stocks.

Triple bottom stocks chartink. There are three equal lows followed by a break above resistance. 4) triple bottom pattern:just opposite of triple top pattern and many times acts as support zone for stocks.expert traders buy stocks near this support zone if other technical indicators are supporting while new to technical. Get live nifty chart intraday (nse), nifty future charts at chartink.com, with various indicators such as ichimoku cloud, rsi, macd, slow/fast stochastic, bollinger band, parabolic sar, donchain channel, avg true range, adx and many more at chartink.com

However, with that third point also comes that much more belief in the new support being established. 13 rows triple top offers one of the bets methods to have a look at the major resistance level. The triple bottom is a lot like the double bottom, except there are three support points instead of two.

Create your own customized stock screener & scanner to identify stock breakouts, find stocks above a particular indicator value, like rsi above 70, 80. Stocks hitting triple bottom in daily candle with increasing volume and cost technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Fii trading activitydii trading activity.

Stocks above their 50 day moving average (dma) chartink.com launches current days’ candle delayed by 15 minutes. Chartink plans real time charts for nse. Single page application for faster download time , quick sorting, filtering, export data.

Triple bottom patterns can resemble other patterns as it’s developing. For example filter bullish engulfing on. This makes the triple bottom a substantially more powerful chart pattern.

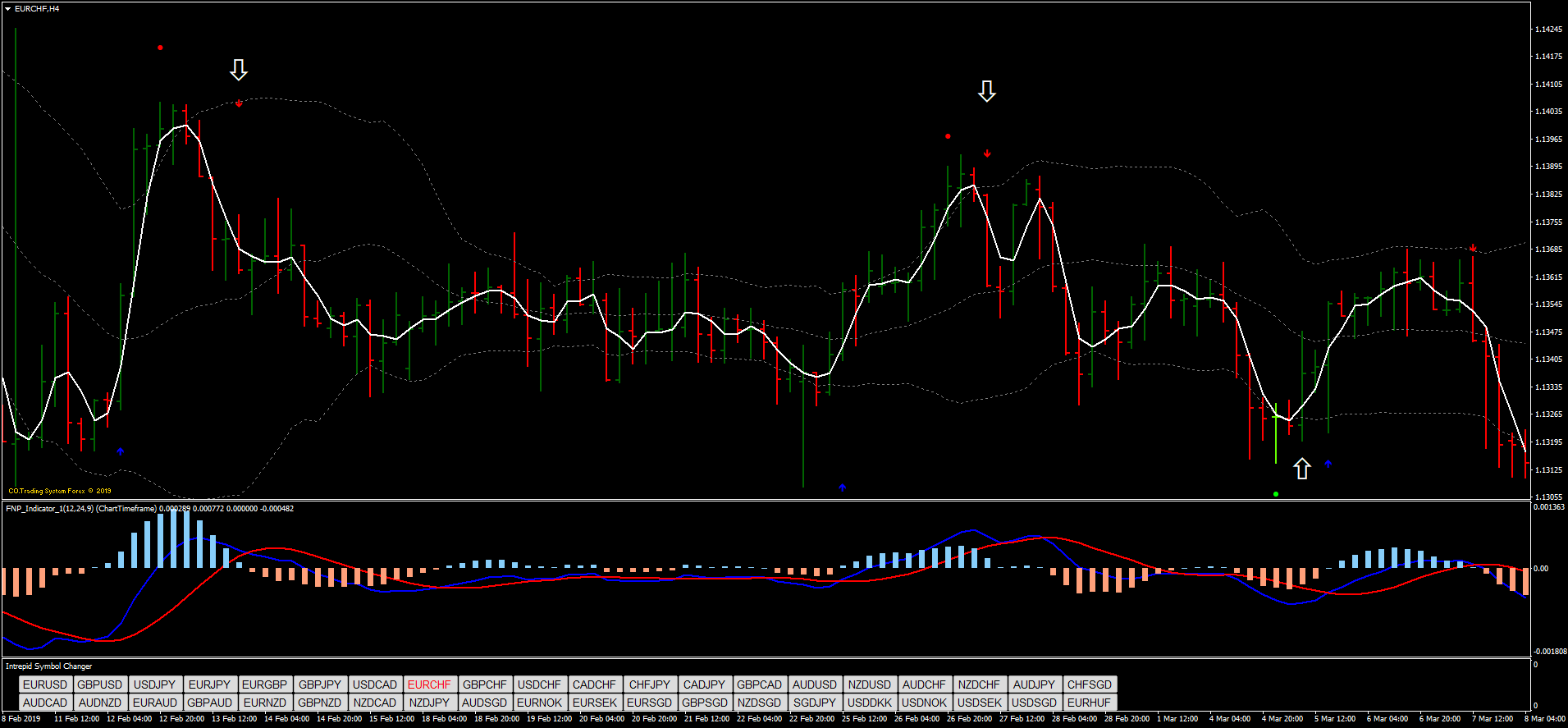

Currently the chart plots eod candle sticks and 5, 10, 15 minutes simple moving average. Powerful eod pattern and trendline screener helps you to screen for classical technical reversal patterns such as head & shoulders pattern, inverted head & shoulders pattern, double top pattern, double bottom pattern, triple top pattern and triple bottom pattern, bullish and bearish trendlines, triangle chart patterns in seconds. Triple bottom stocks, crypto, forex or futures.

114 rows they are often tracked using rsi (relative strength index) which has a value. You can find them on any type of chart with a candlestick. What is triple bottom stock pattern ?

Features of using chart pattern screener in mytsr. Often act as a resistance level for stocks and most of the times it is broken on the downside. Zoom out and look at the daily, hourly, and other time frames before you enter that trade on the 5.

These patterns are bullish reversals created in bearish trends. Hence the importance of being able to see patterns within patterns. This means implications there have been three failed attempts at making new lows in the same area, followed by a price move up through resistance.

The triple bottom reversal is a bullish reversal pattern typically found on bar charts, line charts and candlestick charts. Likewise, you can screen out stocks forming other patterns like stocks forming marobozu, stocks forming shaven tops, stocks forming shaven bottoms, stocks forming bullish engulfing, bearish engulfing, tweezers, stocks forming morning star, evening star, stocks forming double bottom, stocks forming triple bottom, double top, triple top, stocks forming head and shoulders etc. Daily moving average 30 dma 50 dma 150 dma.

The triple bottom stock pattern is a chart pattern used in technical analysis that’s identified by three equal lows followed by a breakout above the resistance level. All of the screeners and updated live during market hours & can be run for daily/weekly/monthly basis. Search best stocks for next day trading on basis of indicators, moving average,candlesticks pattern,fibonacci retracement , gaps created / filled, chart patterns like triangle , rectangle , double top, double bottom , triple top , triple bottom , falling and rising wedges and most important you can scan stocks which are trading near their.

These include double tops and bottoms, bullish and bearish signal formations, bullish and bearish symmetrical triangles, triple tops and bottoms, etc. First bottom / date mid point / date second bottom / date volume chart; When the third valley forms, it is unable to hold support above the first two valleys and results in a triple bottom breakout.

List of oversold and overbought stocks. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance.

0 komentar:

Posting Komentar